broward county business tax receipt form

Garcia Miami-Dade Property Appraiser. Broward Legal Directory is a free resource for anyone wanting information about legal issues in Broward County Florida.

A registration form must be completed and submitted to the Tourist Development Tax Section.

. This is effected under Palestinian ownership and in accordance with the best European and international standards. Quickly search property records from 25 official databases. LOCAL BUSINESS TAX All entities doing business are required to pay local business tax LBT except for those granted exemption under the Local Government Code LGC and special laws.

Broward County ePermits One Stop. Eglin Parkway Shalimar FL 32579 850 651-7300. Box 3353 West Palm Beach FL 33402-3353.

To visit your tax collectors website choose your county. License Section 115 S. Record searches are limited to the first 200 results.

Contact Numbers for Information. Filing Date range searches must include Date From and Date To values in the proper format. The median property tax in Volusia County Florida is 1713 per year for a home worth the median value of 186300.

Business tax receipts require an application and a. Business tax receipts are required by some local governments to show proof that a business tax payment was made andor a business is able to operate within a certain city or county. Looking for FREE property records deeds tax assessments in Broward County FL.

After registering a filing. All businesses must maintain a current Business Tax Receipt or the Tax Collector has the authority to close the business until the requirement is met. Okaloosa County Tax Collector 1250 N.

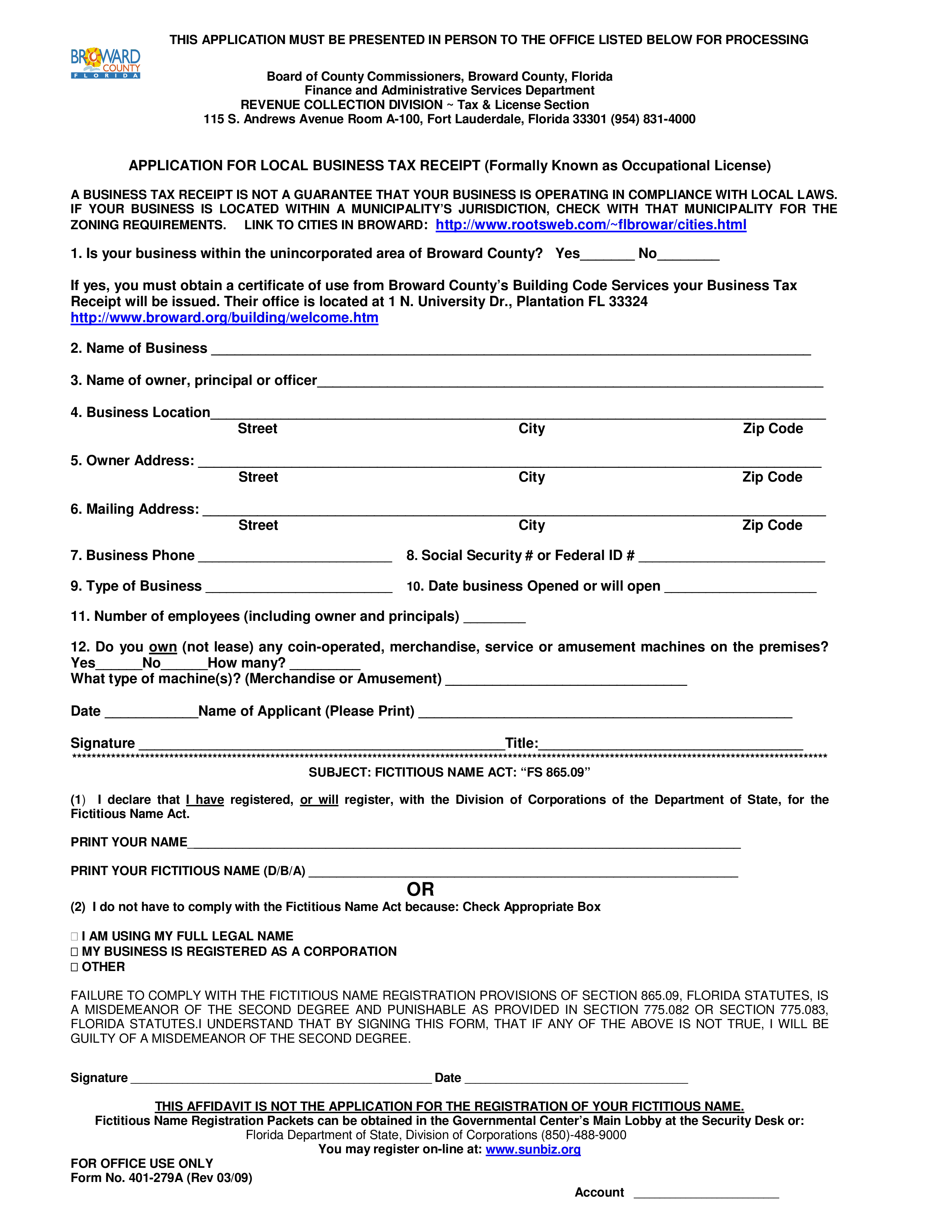

New Business Tax Receipts are issued any time during the year for 35 and expire on September 30th. Owner Builder Affadavit Roof Submittal Packet Special Building Inspector Form Window Door Shutter Submittal Package Contractor Registration Form 2021. Board of County Commissioners Broward County Florida.

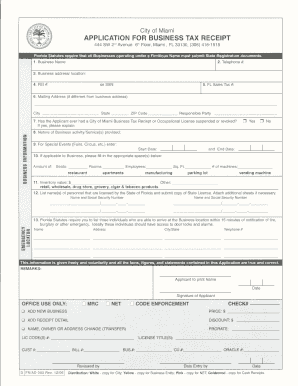

Get an Orange County business tax receipt. Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199. Monday through Friday or you may call us at 305-375-4712 if you have any questions that do not require an.

Volusia County collects on average 092 of a propertys assessed fair market value as property tax. Complete the Application for Local Business Tax Receipt make sure all appropriate zoning information has been completed. At the Local Level.

Checks are made payable Joe G. 20 or quarterly within the first 20 days of January and of the first month of each subsequent quarter. If you do not renew your Countys Business Tax Receipt by September 30 it becomes delinquent October 1 and you will be assessed a penalty if you attempt to renew for the following year.

Local Business Tax Receipt Online Form. CocoGRAM E-newsletter Development Review. All property owners with a homestead exemption receive an automatic residential renewal receipt in late December under the postal order Pedro J.

If you do not receive your renewal notice you should contact. Registration Form and Instructions. While January 1 2022 is the date used for setting your assessed value for the August 2022 TRIM proposed tax Notice sent by our office and the November 2022 tax bill sent by Broward Countys Records Taxes Treasury Division the 2022 value is based upon qualified sales and market data for similar properties in the same or comparable.

Alachua Baker Bay Bradford Brevard Broward Calhoun Charlotte. Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 72 KB Local Business Tax Receipt Exemption Application Form PDF 149 KB Property Taxes. Business Tax Complaint Form 2151 downloads Business Tax Transfer Affidavit 2198 downloads Primary Sidebar.

How To Pay Tourist Development Tax. Orlando business owners also need an Orange County business tax receipt. Taxpayers registering for Tourist Development Tax may be required to obtain a Broward County Local Business Tax Receipt.

The Broward County Clerk of Courts will resume public services at all locations beginning at 8 am. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Business Names with less than three characters will return exact matches only.

All businesses must have both city and county business tax receipts. Palm Beach County Tax Collector Attn. The tax can be paid annually on or before Jan.

The Orlando business tax receipt called a business tax and certificate of use costs about 20 and must be renewed annually. Real Estate and Tangible Personal Property Tax payments may be placed in a drop box during regular business hours. Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954 831-4000 APPLICATION FOR LOCAL BUSINESS TAX RECEIPT Formally Known as Occupational License.

Volusia County has one of the highest median property taxes in the United States and is ranked 630th of the 3143 counties in order of median property taxes. On Monday June 1 2020 enabling customers to conduct Clerk of Court related business in person. 02140 Fort Lauderdale FL 33301 provides local and Florida Supreme Court approved Family Law Forms for a fee to those who choose to represent themselves or cannot afford an.

Fill out Online form below. Drop boxes are located inside the lobby area of each Tax Collectorâs Office Service Center location in Polk County or in the Legion Tag Agency in Winter Haven. The Pro Se Self Help Unit located at the Broward County Central Courthouse Judicial Complex West Building Domestic Violence Division 201 SE 6th Street 2nd Floor Room.

The Orange County Tax Collectors Office is located at 200 South Orange Avenue Orlando on the 16th floor. Click here for more information. Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida.

Failure to renew a Business Tax Receipt subjects the owner to delinquent fees. If your business is located within an incorporated municipality city limits a City Business Tax Receipt must be procured before a Brevard County Business Tax Receipt can be issued. Read Full Press Release.

Our regular business hours are 800 am. Welcome to Broward County BTExpress Use the buttons below to apply for a new Business Tax account and obtain your Broward County Business Tax receipt or request a change to your existing Business Tax account. We provide information about local vendors Judges public databases and legal topics ranging from real estate personal injury car accidents probate to slip and falls and other common legal issues faced by Broward County residents and non-residents.

401-279A Rev 062018 Account. Business Name is a required field. 2021 Property Tax Bill Brochure PDF 220 KB 2021 Taxing Authorities Phone List PDF 72 KB Frequently Asked Questions about Your Tax Bill PDF 240 KB.

Business Tax Department PO. These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes.

Hallandale Beach Area Broward County Local Business Tax Receipt 305 300 0364

Application For Local Business Tax Receipt Templates At Allbusinesstemplates Com

Permit Source Information Blog

Fill Free Fillable Broward County Florida Pdf Forms

Top Notch Movers Is A Professional Moving Company In Fort Lauderdale We Move Miami Dade Broward And Palm Beach Counties Broward Business Tax Moving Company

Free 5 Sample Business Tax Receipts In Ms Word Pdf

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller